If you’re searching for a reliable and time-tested method of growing wealth while ensuring financial security, look no further than dividend growth investing. In this article, we’ll explore the ins and outs of this investment strategy. It involves investing in stocks of companies that consistently increase their dividend payouts over time.

Table of contents:

Why Dividend Growth Investing Matters?

Dividend growth investing has been a favorite among seasoned investors for decades. It provides a structured and potentially lucrative approach to building wealth while minimizing some risks associated with stock market investments.

Let’s break down the key aspects of dividend growth investing and why it should matter to you.

Steady Income Streams

One of the primary attractions of dividend growth investing is the promise of steady income streams. When you invest in dividend-paying stocks, you claim a portion of the company’s earnings as dividends.

These dividends can provide a reliable source of income, which can be particularly valuable during economic downturns or retirement. For example, consider the VIG ETF, which currently offers an attractive 2.5% dividend yield. When it comes to individual stocks categorized as dividend growers, take Home Depot(HD), for instance, which provides a 3% yield along with a steady, reliable growth rate of 15%.

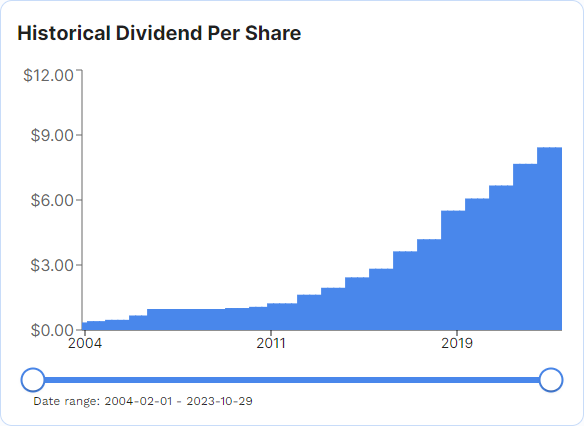

Here’s an example of how your dividend payment for a single HD stock grew from 0.28 to 8.36 over 20 years. While 20 years may seem like a long time to wait, the potential for a 30x increase in your dividend payment makes it a good deal.

Reaping the Benefits of Compounding

Dividend growth investors also benefit from the power of compounding. When companies consistently increase their dividends, their returns start to snowball. This compounding effect means that over time, your income from dividends can significantly exceed your initial investment.

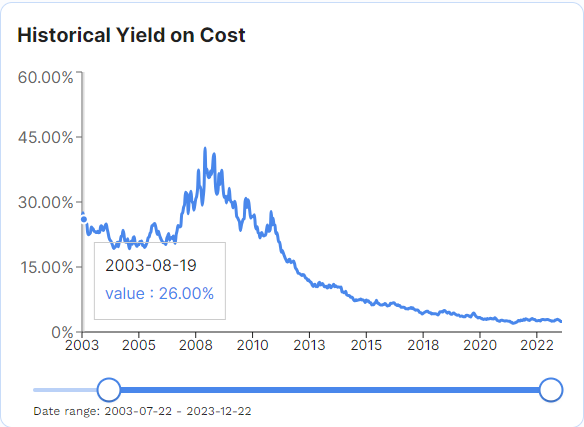

For instance, imagine you invest in a stock that yields 3% in dividends, and the company increases its dividend payout by an average of 15% per year. Over a couple of decades, your yield on cost, may far surpass the initial 3%.

Here’s an example of the same HD stock that grew its dividend at a 14.32% rate over a decade. If you’re still holding it, you’re enjoying a juicy ~25% yield.

Reduced Volatility and Risk Management

Dividend growth investing is often considered a safer and more conservative investment strategy compared to high-growth, non-dividend-paying stocks. This leads to the question: Why is there less risk and volatility? In my view, it’s because businesses in this category must consistently perform well to maintain their dividend-paying status. Paying dividends and increasing them over time is challenging for companies with flawed business models.

Investing in such companies can help protect your investments during market downturns. The dividend income provides cash flow that can be reinvested in the company itself or used to explore other opportunities.

Long-Term Wealth Building

Dividend growth investing is all about the long term. This strategy is ideal for investors who prioritize wealth preservation and steady growth over quick, speculative gains. While you may not see rapid price appreciation in your investments, you can count on the income stream and the slow, steady appreciation of the stock price over time.

Here’s some historical proof:

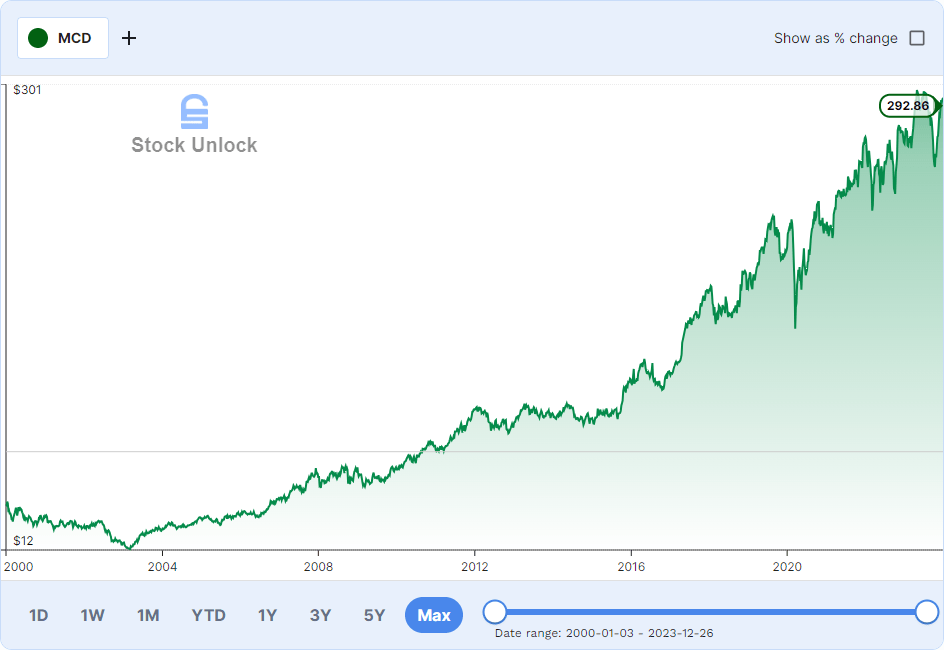

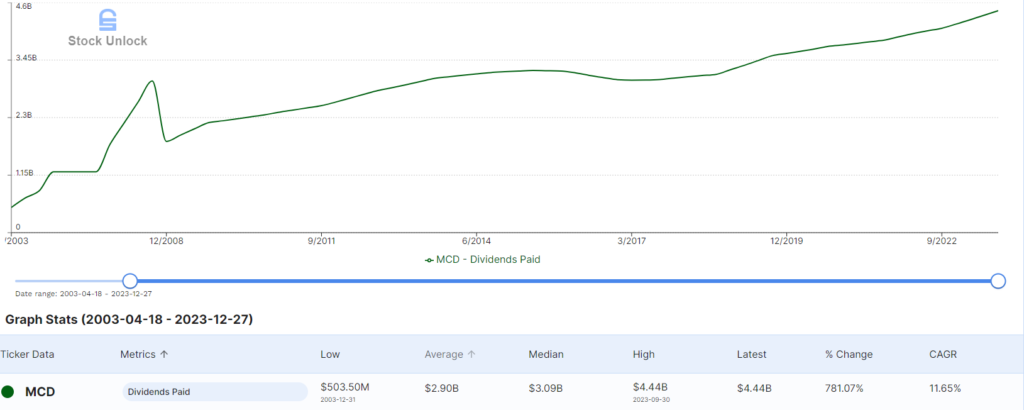

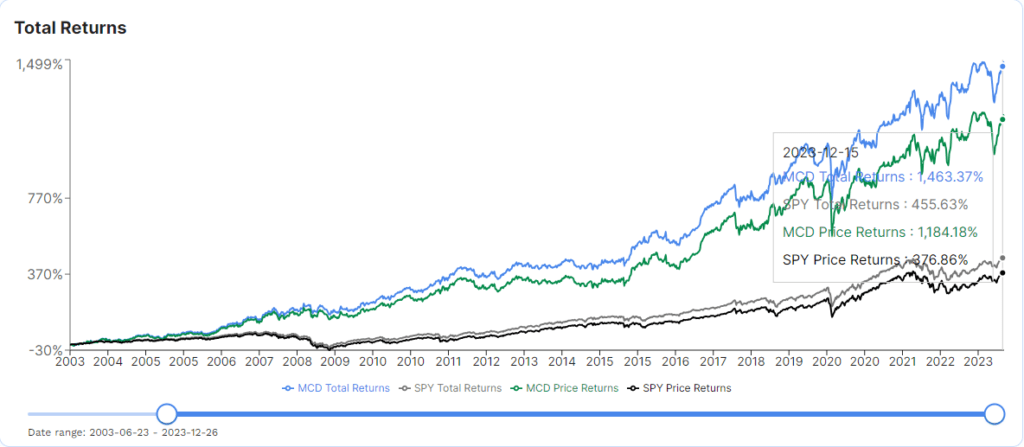

McDonald’s (MCD) is a great example of a dividend grower for the last two decades, demonstrating:

Great price appreciation of around 14%:

A consistently growing dividend of about ~11.5%:

This combination has allowed dividend growth investors to perform exceptionally well compared to the market.

It’s important to note that McDonald’s is not the only example of this strategy performing well. Companies like Coca-Cola (KO), Johnson & Johnson (JNJ), PepsiCo (PEP), The Home Depot (HD), and many others have allowed dividend growth investors to consistently outperform the market.

The Bottom Line

Dividend growth investing offers an established path for your investment journey. By thoughtfully selecting high-quality dividend stocks and reinvesting your earnings, you can benefit from the incredible power of compounding. However, it’s essential to recognize that no single investment strategy fits everyone. You must tailor your approach based on factors such as your age, financial objectives, and risk tolerance.

If you’re interested in building your dividend growth portfolio, check my comprehensive step-by-step guide.

Leave a Reply